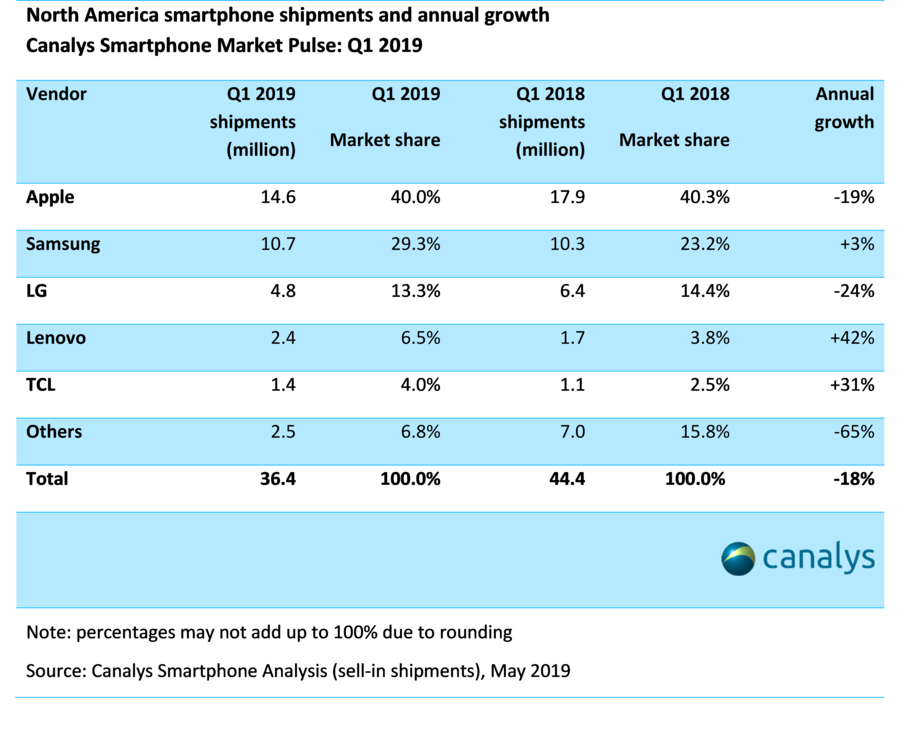

US Smartphone Market Dropps 18%, A five Year Low. Decline Lead By Apple, LG - A Report

According to Canalys, an independent analysis company, Samsung narrowed Apple’s lead in the first quarter in 2019, shipping 29% of North America’s smartphones, against 23% in Q1 2018. The decline is due to Apple's poor performance and the absence of ZTE phones in the market according to the same analysts.

“Samsung brought real differentiation to its Galaxy S10 devices, Its triple camera, ultra-wide-angle lens, hole-punch display and reverse wireless charging all raised consumer interest. While these technologies are not new, Samsung is among the first to bring them to the US in a mass-market smartphone, and the appeal of such new features will be important for other launches this year. Samsung also benefited from carrier promotions in Q1, which used the Galaxy S10e as an incentive. But it will come under pressure later in 2019 as other vendors, such as OnePlus, follow suit with new features, while Google starts expanding into additional channels and price bands, and ZTE attempts to re-establish its footprint at the low end.” said Canalys Research Analyst Vincent Thielke.

Apple's iPhone shipments were down 19% and shipped 14.6 million iPhones in Q1 2019, maintaning a 40% share of the North American smartphone market. According to the Analysts, this was aided by carrier and retail discounts on older models, such as the iPhone 6S and iPhone 7, as well as the growing use of trade-in promotions etc. Yet all those factors were not enough to offset the shortfall in iPhone shipments in Q1.

On Apple, Thielke said that “Apple’s fall in Q1 followed particularly high shipments of flagship iPhones in the previous quarter, But there was a disconnect between channel orders and consumer demand, which then caused early shipments in Q1 to be challenging for Apple. But moving into March, we did see an uptick in iPhone XR shipments, an early sign that these challenges may be starting to ease at home. Apple has shown how vital trade-ins have become by moving the mechanism to the front and center of its ordering process, and it now frequently uses the net price in its flagship iPhone marketing. The momentum of trade-in promotions in Q2 and Q3 will determine the extent to which Apple can counter negative market forces, such as longer device lifecycles. But the key challenge in coming months remains that its latest iPhones are just not different enough, though new ones are on the way. For its performance to improve in 2020, Apple will need to emphasize radical new features that are most likely to impress consumers.”

Via Canalys where you have access to the full report.

0 comments:

Post a Comment